SCRYPT, the Swiss-licensed institutional crypto partner for trading, custody, and investment access, has partnered with Gauntlet, the industry’s leading provider of quantitative risk and optimisation models for DeFi. Together, the firms are launching institutional access to transparent and risk-managed DeFi strategies at scale.

Bridging Traditional Finance and DeFi innovation

Decentralized finance (DeFi) has become one of the most active and liquid markets globally, with total value locked - reaching $103.8 billion on February 2nd 2026, according to DefiLlama. Despite this scale, institutional investors have had limited access, constrained by regulatory uncertainty, lack of deep expertise, fragmented infrastructure, and opaque risk frameworks.

This pioneering partnership directly addresses that gap. SCRYPT provides auditable, compliant, and secure 24/7 access to DeFi yield markets for banks, funds, and professional investors, built on bank-grade security, best-in-class custody infrastructure and Swiss regulated environment. Gauntlet’s on-chain vault strategies - already managing more than $1.5 billion across DeFi assets - will be available through SCRYPT’s Swiss-licensed portfolio management structure. As a vault curator, Gauntlet develops, deploys, and oversees vaults that run DeFi yield strategies backed by battle-tested quantitative models.

The demand for institutional DeFi is real – what’s been missing is a reliable way in. By combining Gauntlet’s leading market research and on-chain risk models with our regulated institutional framework, we’re bringing Traditional Finance standards to DeFi innovation and empowering firms to access bespoke yield strategies with clarity and confidence

Norman Wooding, Founder & CEO at SCRYPT

"Gauntlet's mission has always been to bring quantitative rigour to decentralized markets. By partnering with SCRYPT, together we are providing a seamless, compliant, and scalable conduit for major European institutions to access superior, risk-managed DeFi yield strategies."

Rahul Goyal, Head of Institutional Partnership at Gauntlet

Together, SCRYPT and Gauntlet will empower professional and institutional investors worldwide to access DeFi strategies with confidence and reliability at scale.

“Our collaboration with Gauntlet extends Gauntlet’s risk-managed vault strategies into a fully regulated environment a high quality, institutional marketplace. Together, we’re creating a new paradigm for how institutional capital engages with DeFi - safely, transparently, and at scale.”

John Orthwein, Head of DeFi at SCRYPT

Get in touch with the SCRYPT team today to learn more about the strategies available.

--

About SCRYPT

SCRYPT is the Swiss-based institutional crypto partner behind firms starting or scaling their digital asset journey. By combining deep market access, crypto-native expertise, and proprietary infrastructure, SCRYPT enables institutions to trade, custody, and invest in digital assets with confidence. Its clients include banks, brokers, asset managers, hedge funds, crypto projects, and commodity traders.

Licensed as a Portfolio Manager under the Swiss Financial Market Supervisory Authority (FINMA), SCRYPT delivers regulated, risk-managed, and high-performance access to digital asset portfolios at scale.

To learn more about SCRYPT, visit: www.scrypt.swiss.

About Gauntlet

Gauntlet is the leading quantitative risk manager in onchain finance, building strategies for managing the financials of protocols, applications, and chains. Gauntlet equips the largest FinTechs, Financial Institutions, and investors with data-driven strategies to maximize the value of funds onchain.

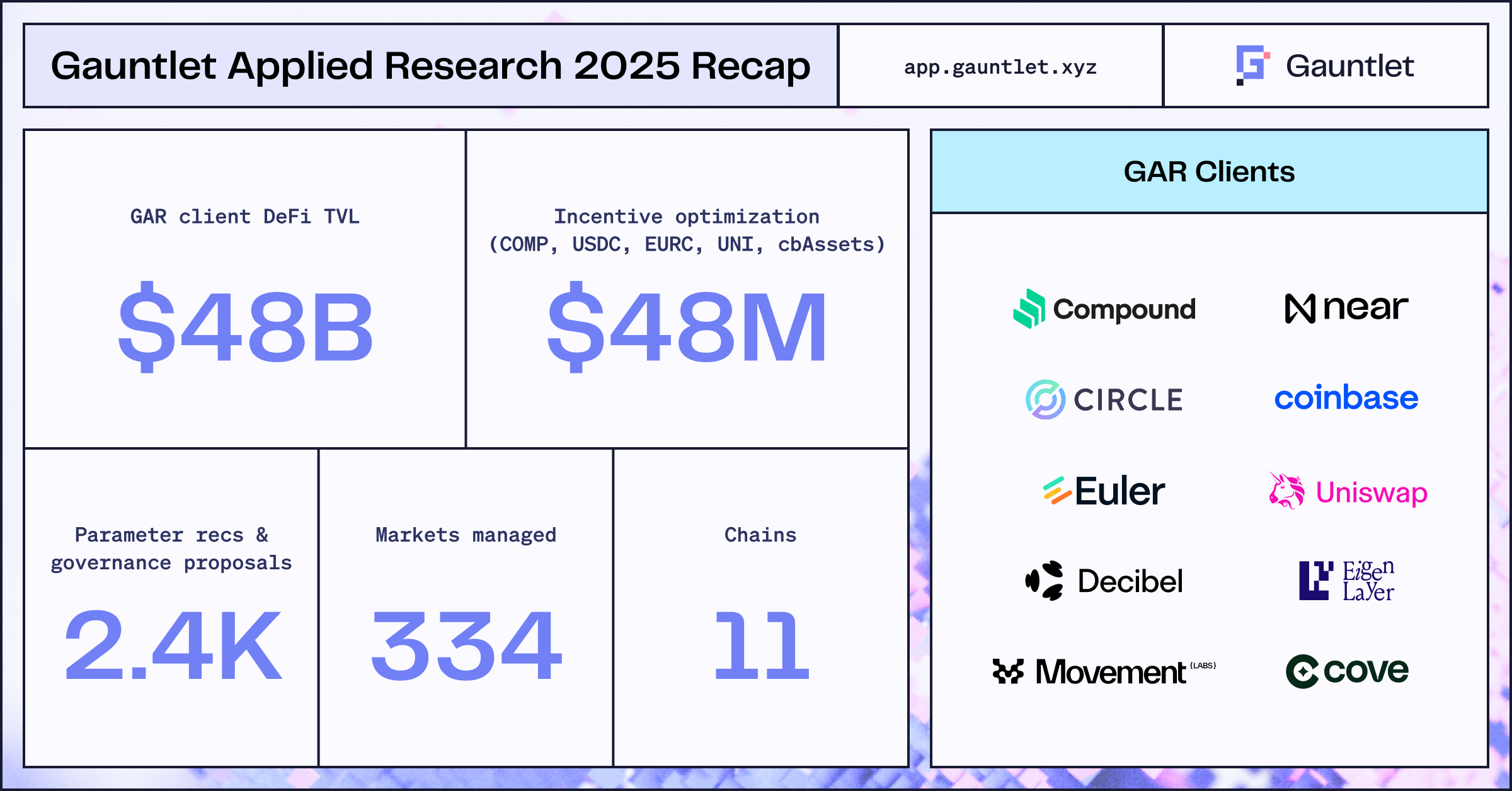

Gauntlet monitors risk for over $42B onchain, and more than $1.5B is allocated to Gauntlet’s onchain yield generation strategies across more than 80 vaults and 10 chains. Over 50,000 users globally have generated $30M+ in yield since the first Gauntlet-curated vaults were launched in February 2024.

Case Study

View the full presentation

Read the full paper